What is Crypto Mining? – Explained

If you’ve been following our blogs at Myth Money for a while, you’re probably familiar with crypto mining. It is yet another activity that people indulge in to gain financial rewards in the form of crypto tokens. As promised in the previous blog on altcoins, today we will take a deeper look at one of the most integral pillars of crypto which is Cryptocurrency Mining.

A popular opinion on crypto mining is that the activity simply creates new tokens of its respective cryptocurrencies. Although the statement isn’t wrong, limiting its functionality to just one of its purposes is unfair to this vital act!

A great way to better understand crypto mining is to think of Blockchain and crypto mining as two sides of the same coin. (I highly suggest reading our blog post on Blockchain to better understand this concept as they’re highly related!). So without further ado, let’s jump into it!

Defining Crypto Mining

Cryptocurrency mining is primarily a process that solves complex cryptographic math equations by using advanced software. This process creates new tokens on the blockchain, which are rewarded to the miners. The miners then have the choice of either selling those tokens or holding them as an investment.

Along with the creation of tokens, Crypto-mining fulfills the following purposes:

- Crypto mining helps maintain the blockchain and the transactions that happen on it by validating & upholding the transactions occurring on that respective blockchain.

- This then adds those transactions to the distributed ledger on blocks. Creating a maintained solid unchangeable record of all the transactions that have occurred.

- Crypto mining ensures that a transaction is made and recorded once, but verified extensively. This also makes certain that double-spending of the crypto tokens cannot occur.

In order to ensure security, most blockchains such as Bitcoin only allow verified miners to maintain these transactions. This protects their blockchains and digital ledgers from attempts of manipulation and double-spending. Put simply, someone would have to control over half of the mining power in the entire network (nearly impossible) before they could manipulate the blockchain. The whole mining process is based on the Proof-of-Work consensus model. We’ve discussed the PoW model in-depth in our previous article on Altcoins, so again, don’t forget to check that out!

What is its purpose?

Similar to the traditional mining of valuable metals and stones, Cryptocurrency mining is hard and potentially rewarding. Just as traditional mining only pays off when something is found and extracted, crypto mining also only pays off after a miner’s computer is able to mine (solve some algorithm/equations) a cryptographic hash.

The situation is similar to the realist’s view of a ‘zero-sum game’(See Investopedia’s explanation for a deeper understanding). One miner’s gain is another’s loss. To oversimplify the concept, it’s similar to a car race, where only the best/fastest car earns the most reward. In this case, the first miner to solve the equation is said to have found/won the “golden nonce”. Whoever solved it first is then able to validate that transaction and add that to the digital ledger. Hence, they earn the reward for themselves.

How has the practice evolved over the years?

In its initial days, Mining cryptocurrencies was quite simple and straightforward. All a miner needed was a GPU chip on their traditional PC and they could easily mine Bitcoin. When the practice first began in 2009 with the advent of Bitcoin, many considered it a wonderful tech to easily make money in their sleep without incurring any risks.

Sadly, excessive demand led to GPU manufacturing companies raising their prices, scalpers buying cards before the general public can even see them in stores, and consequently skyrocketing profits resulting at the same time. However, as the currency and mining process evolved, the process got more complicated. Even today, the traditional GPU chips just don’t cut it anymore for mining some coins.

With time the mining industry became more competitive and miners started employing more advanced software. To maintain the balance of equilibrium in this competitive world, the difficulty of those mathematical equations rose alongside it. This resulted in a scarcity of the coin and combined with the high demand for Cryptocurrencies such as Bitcoin during the days of market frenzy that engulfed various parts of the globe in 2017; this led to the world witnessing the first major Bitcoin bubble of 2017.

Crypto Mining Today, Too Many Drawbacks?

Now that we’ve discussed the past, let’s take a look at what’s needed to mine Cryptocurrencies in the current era.

At the time of writing, in order to mine cryptocurrencies, you need a specialized and costly GPU and/or an application-specific integrated circuit (ASIC) miner that at the minimum can cost over $2,000 (USD) apiece. Further, there are costs many may not think about when starting crypto mining. GPUs indulged in the mining process must have access to an uninterrupted internet connection at all times. Due to the increased hash complexities, more power is needed for mining. This means increased electric costs which can be considerably high for some residential areas. As a result, it is common practice for people indulged in crypto mining on a large scale to position their mining rigs in areas with very low temperatures to minimize this expense. It seems that this sector is getting further from the reach of day-to-day crypto enthusiasts, and may become a lucrative option only for the rich.

Different types of mining techniques!

CPU Mining

The process of mining can be fulfilled through various different techniques. Initially, people simply used their home CPUs for working algorithms. However, due to high electrical consumption, cooling cost, and a very low RoR (Rate of Return) over time, this choice has become impractical and outdated.

GPU Mining

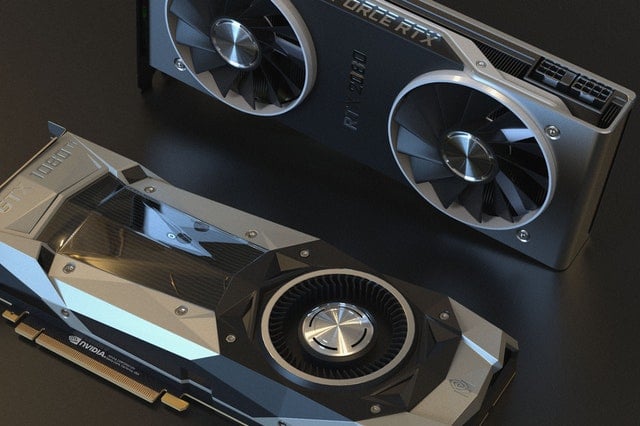

Another technique extensively discussed above and perhaps the most widely used option is GPU mining. For this method, the only major costs for a miner would be the motherboard, GPUs, and cooling system. It is considered one of the best methods for mining as it allows miners to develop a considerable amount of computational power. This is achieved by combining a group/array of GPUs to work under one mining ring. These are then all used collectively to work for the solution of one equation.

ASIC Mining

While GPU mining is a good technique for mining, at the end of the day GPUs are essentially general-purpose equipment. In a day and age that demands targetted technology, ASIC mining was developed as a technology with the sole purpose to mine cryptocurrencies. However, one major drawback with ASIC mining is that it quickly becomes out-of-date as the complexity of mining increases. Hence, they are an expensive and often a less practical choice.

Cloud Mining

Since the costs of setting up GPU and ASIC mining are high and increasing at a rate that seems perpetual, this technique has become quite popular. Cloud mining essentially allows miners to leverage (borrow) the facilities and power of huge crypto mining corporations. These hosts which offer both free and paid rentals are available online and people can easily rent mining rigs from them to begin their crypto mining journey!

Conclusion

The Crypto mining sector is a constantly changing space. As new technologies emerge, the space incurs significant changes as well. So if you’re an aspiring crypto miner, be prepared to have a journey that comes with a steep learning curve, constant learning adjustments, and many possible required technology upgrades.

Moreover, you should consider the concerns regarding the sustainability of the PoW mining framework. Since the process is energy-intensive, mining has a direct relation to fossil fuel consumption. As a result, many Crypto-tokens such as Ethereum are considering or already are transitioning to more environment-friendly networks such as the Proof-Of-Stake framework.

Lastly, if you’re interested in the practice solely due to its monetary returns and don’t want to incur the expenses of setting up a mining rig of your own, and/or the arduous job of learning how to mine cryptocurrencies. There’s yet a way for you to get what you want without having to go through the lengthy process by simply buying stocks of crypto-mining firms. Yes, they exist! (Not financial advice, just an option)

Hamza has been passionate about the subjects of finance, investment & the stock market ever since he read his first book encompassing the 3 respective niches: The Intelligent Investor by Benjamin Graham. He’s been investing, analyzing, and writing articles on the stock market, cryptocurrencies, real-estate & commodities for over 2 years.